Tuesday, November 17, 2015

Positive and Negative Risks with High Uncertainty in the Context of Syrian Refugees after Paris

Thursday, August 22, 2013

Warm Weather Increases Albedo in Key Regions

The first half of this post by Willis Eschenbach is valid, but not interesting to me. The second half is very interesting and should stand alone, so I've reproduced it here:

In any case, let me move on to the more serious topic I mentioned above, regarding Dr. Trenberth’s infamous “missing heat”. Let me suggest where some of it is going. It’s going back out to space.

One of the main thermal controls on the planet’s heat balance is the relationship between surface temperature on one hand, and the time of day of cumulus and cumulonimbus formation in the tropics. On days when the surface is warmer, clouds form earlier in the day. The opposite is true when the surface is cooler, clouds form later. This control operates on an hourly basis. I’ve shown how this affects the daily evolution of tropical temperature here and here using the TAO moored buoy data. Here’s a bit of what I demonstrated in those posts. Figure 2, from the second citation, shows how cold mornings and warm mornings affect the evolution of the temperature of the ensuing day.

Figure 2. Average of all TAO buoy records (heavy black line), as well as averages of the same data divided into days when dawn is warmer than average (heavy red line), and days when dawn is cooler than average (heavy blue line) for each buoy. Light straight lines show the difference between the previous and the following 1:00 AM temperatures.

The control of the surface temperature is exerted in two main ways: 1) in the morning, cumulus cloud formation reduces incoming solar radiation by reflecting it back to space, and 2) in the afternoon, thunderstorms both increase cloud coverage and remove energy from the surface and transport it to the upper troposphere. We can see both of these going on in the average temperatures above.

The black line in Figure 2 shows the average day’s cycle. The onset of cumulus is complete by about 10:00. The afternoon is warmer than the morning. As you would expect with an average, the 1 AM temperatures are equal (thin black line).

The days when the dawn is warmer than average for each buoy (red line) show a different pattern. There is less cooling from 1AM to dawn. Cumulus development is stronger when it occurs, driving the temperature down further than on average. In addition, afternoon thunderstorms not only keep the afternoon temperatures down, they also drive evening and night cooling. As a result, when the day is warmer at dawn, the following morning is cooler.

In general, the reverse occurs on the cooler days (blue line). Cooling from 1 AM until dawn is strong. Warming is equally strong. Morning cumulus formation is weak, as is the afternoon thunderstorm foundation. As a result, when the dawn is cooler, temperatures continue to climb during the day, and the following 1AM is warmer than the preceding 1 AM.

Regarding the reduction in incoming solar energy, in a succeeding post called “Cloud Radiation Forcing in the TAO Dataset“, I provided measurements of the difference between the shortwave and longwave radiation effects of tropical clouds, based on the same TAO buoy data. The measurements showed that around noon, when cumulus usually form, the net effect of cloud cover (longwave minus shortwave) was a reduction of half a kilowatt per square metre in net downwelling radiative energy.

In addition to that reduction in downwelling radiation, there is another longer-term effect. This is that we lose not only the direct energy of the solar radiation, but also the subsequent “greenhouse radiation” resulting from the solar radiation. In the TAO buoy dataset, the 24/7 average downwelling solar radiation reaching the surface is about 250 W/m2. Via the poorly-named “greenhouse effect” this results in a 24/7 average downwelling longwave radiation of about 420 w/m2. So for every ten W/m2 of solar we lose through reflection to space, we also lose an additional seventeen W/m2 of the resulting longwave radiation.

This means that if the tropical clouds form one hour earlier or later on average, that reduces or increases net downwelling radiation by about 50 W/m2 on a 24/7 basis. This 100 W/m2 swing in incoming energy, based solely on a ± one-hour variation in tropical cloud onset time, exercises a very strong daily control on the total amount of energy entering the planetary system. This is because most of the sun’s energy enters the climate system in the tropics. As one example, if the tropical clouds form on average at five minutes before eleven AM instead of right at eleven AM, that is a swing of 4 W/m2 on a 24/7 basis, enough to offset the tropical effects of a doubling of CO2 …

Not only that, but the control system is virtually invisible, in that there are few long-term minute-by-minute records of daily cloud onset times. Who would notice a change of half an hour in the average time of cumulus formation? It is only the advent of modern nearly constant recording of variables like downwelling long and shortwave radiation that has let me demonstrate the effect of the cloud onset on tropical temperatures using the TAO buoy dataset.

While writing this here on a cold and foggy night, I realized that I had the data to add greatly to my understanding of this question. Remember that I have made a curious claim. This is that in the tropics, as the day gets warmer, the albedo increases. This means that we should find the same thing on a monthly basis—warmer months should result in a greater albedo, there should be a positive correlation between temperature and albedo. This is in contrast to our usual concept of albedo. We usually think of causation going the other way, of increasing albedo causing a decrease in temperature. This is the basis of the feedback from reduced snow and ice. The warmer it gets, the less the snow and ice albedo. This is a negative correlation between albedo and temperature, albedo going down with increasing temperature. So my theory was that unlike at the poles, in the tropics the albedo should be positively correlated with the temperature. However, I’d never thought of a way to actually demonstrate the strength of that relationship at a global level.

So I took a break from writing to look at the correlation of surface temperature and albedo in the CERES satellite dataset. Here’s that result, hot off of the presses this very evening, science at its most raw:

Figure 3. Correlation between albedo and temperature, as shown by the CERES dataset. Underlying data sources and discussion are here.

Figure 3. Correlation between albedo and temperature, as shown by the CERES dataset. Underlying data sources and discussion are here.

Gotta confess, I do love results like that. That is a complete confirmation of my claim that in the tropics, as the temperature increases, the albedo increases. Lots of interesting detail there as well … fascinating.

My conclusion is that Dr. Trenberth’s infamous “missing heat” is missing because it never entered the system. It was reflected away by a slight increase in the average albedo, likely caused by a slight change in the cloud onset time or thickness.

My regards to everyone,

w.

Tuesday, July 17, 2012

Biggest Mistake in Office

Sunday, May 29, 2011

Obama 2012!

Friday, April 29, 2011

Borrow More... Or Else!

JPMorgan Chase did just that.

Tuesday, March 08, 2011

Expenses Rising as Percentage of Disposable Income

Data from BEA Tables 2.6 and 2.4.5U

UPDATE (3-9-11): Added savings as a percentage of NDE and 12 month smoothed trendline. I believe the upward spikes near the end (corresponding to downward spikes NDE/DI) are tax refunds.

Sunday, January 16, 2011

QE Haiku

Monday, November 29, 2010

Ask Not How QE Can Cause Inflation

Wednesday, October 13, 2010

What's Black, White, Stinks to High Heavens, and is Proud of it?

Wednesday, July 14, 2010

Positive Feedbacks Exist Primarily, and Dominate Only, in Social Phenomena

Thursday, June 24, 2010

McChrystal Reassigned

General McChrystal has been reassigned out of Afghanistan. Rolling Stone has not commented on whether this will affect broader mid-east policy or whether it will continue with its planned draw-down of forces in Iraq.

Friday, June 11, 2010

Fiscal Stimulus

Thursday, May 13, 2010

Highway Data Revised

April 2009 data:

May 2010 data:

UPDATE: From FHWA, Previous numbers are TVT estimates. States submit after 6 months and frequently resubmit data and update data. The final (HPMS) numbers are published a year and half later. This year's data for 2007, 2008, and 2009 were largely higher than TVT estimates. Upward revision is normal, but this year's was larger than usual. I wouldn't be suprised if the drive for stimulus dollars has pushed the numbers up.

Thursday, May 06, 2010

More Fuel Efficient Vehicles Are Not Making Us More Efficient

I think it’s clear that we are trying address the wrong end of fuel efficiency. The real bottleneck is on the road. People not accelerating quickly enough and causing congestion (due to misguided beliefs that slow acceleration is more efficient and maybe due to increased cell phone use).

Monday, March 01, 2010

Krugman Keeps on Shovelling

Tuesday, September 01, 2009

Road Traffic and Fuel Consumption through June 2009

Tuesday, August 18, 2009

American Recovery and Reinvestment Act

Saturday, August 08, 2009

Is Cash For Clunkers Actually a Good Idea?

Cash for Clunkers destroys productive capital and does it at a cost that is far, far greater than the value of any delay in fuel consumption that will result from replacing some miles driven with a more efficient vehicle or the reduced congestion due to the smaller number of cars that will be on the road (when we return to full productive capacity, there will be less cars on the road than there otherwise would have been for a few years).

We won’t see much net economic improvement due to the change in capital structure (the shifting of money from tax payers to auto companies and financiers) or any net improvement due to slightly faster attrition in the vehicle fleet.

We might actually see a net improvement in both our transportation efficiency and economic productivity though. Not for any of the reasons suggested by lawmakers, but because of who Cash for Clunkers takes off the roads.

Cash for Clunker will produce effects similar to congestion pricing. Differences in the vehicle fleet make-up won't improve anything, but Cash for Clunkers will make it more expensive for some of the least efficient, least productive, least experienced, slow, and most dangerous drivers to drive.

Friday, July 31, 2009

Sometimes, It Sucks to be Right

Thursday, July 30, 2009

Vehicle Miles Travelled per Gallon of Gasoline Consumed

Monday, July 13, 2009

Thanks Barry. Thanks Congress.

Friday, April 17, 2009

Vehicle Miles Travelled Per Gallon of Gasoline Consumed Since 2000

Friday, February 27, 2009

Congestion Trends, And Do Two Traffic Flows Exist at the Same Time?

The key finding is "a decrease in the Travel Time Index of 3.5% from 2007; more than

reversing the increase of 1.9% between 2007 and 2006".

This conflicts with my experience and analysis of fuel economy. For most of 2008, I've felt that my drive times were longer, except in recent months. This agrees with the decline in fuel economy. For gasoline, fuel economy declined in most of 2008 and only rebounded slightly at the end of the year. It finished down for the year.

However, a little further thinking reconciles my analysis with the INRIX Report. When diesel and gasoline fuel economy is looked at, fuel economy does begin improving earlier in the year and does end as a net improvement for the year, in agreement with the INRIX report.

Here's what I think is happening.

I think there are two traffic flows that exist at the same time.

Car traffic may have gotten worse while commercial traffic became more efficient.

My thinking is that car drivers responded to gas prices by erroneously accelerating and driving slower, this worsened fuel economy for car drivers. Commercial driving habits probably didn't change much for non-freeway driving. Trucking probably benefited from decreased congestion and also improved fuel efficiency by driving at lower top speeds on the freeway. Car traffic suffered from decreased throughput at intersections and decreased speeds for non-highway driving (below 55MPH, higher cruising speeds are more efficient).

UPDATE (4/27/09): I e-mailed INRIX at the time of this post about some shortcomings in their report, I received no reply other than acknowledgement of receipt. Their reporting is based on data from commercial vehicles. Commercial vehicles behave differently than passenger vehicles. They accelerate more slowly, have cargo that shifts, hit more red lights, etc. Generally, most traffic flows around them, interfering slightly as they merge in front after passing (i.e. diminished passanger vehicle traffic flow could result in slight improvement in commercial vehicle traffic flow). Also, INRIX data compares traffic relative to "free flow" rates. A decrease in free-flow rates will exaggerate improvement in traffic flow. Their reporting also will not recognize diminished flow during non-congested hours, which can be even more costly than gains during congested hours.

Wednesday, February 25, 2009

Cut the Mortgage Interest Deduction

Replace the Interest Rate Deduction with a Principal Payment Deduction. Sure, it'll break some banks with a bad mix of Mortgage Backed Securities holding prepayment risk, but fuck 'em.

This will bring a soft landing as people with large amounts of cash are encouraged to buy houses, without lots of leverage. Demand will be buoyed and banks will be flooded with cash and will have to lend at lower interest rates to compete. It will also move properties to less risky owners. Fast.

Monday, February 23, 2009

Recession in Transit Activity and Fuel Consumption and Fuel Economy

Sunday, January 25, 2009

A Letter to the EPA

Drive Sensibly

Aggressive driving (speeding, rapid acceleration and braking) wastes gas. It can lower your gas mileage by 33 percent at highway speeds and by 5 percent around town. Sensible driving is also safer for you and others, so you may save more than gas money.

While technically correct, this statement is likely to be misinterpreted and lead to worse fuel economy. Rapid acceleration combined with rapid braking results in wasted gas. However, quick but smooth acceleration is more efficient than slow acceleration. Slow acceleration spends more time at less efficient vehicle speeds and at engine speeds that are less efficient while the engine is under the heavy load of acceleration. (However, accelerating too hard at low engine speed uses large amounts of gas when it is inefficient. This is why "quick, but smooth" should be emphasized.)

What is most important is that drivers remain safe and alert. Being aware of what is ahead leads not only to safer driving, but more efficient driving. Avoiding needless braking is where the fuel savings are. Being alert and getting up to speed quickly reduces the burden of congestion, but being over eager will result in waste. A driver should always be going the same speed or slower than the vehicle ahead, unless of course it is safe to go around. Accelerating too much results in unnecessary braking, and acceleration that is wasted and must be done over.

Stops are by far the biggest fuel waster. It should probably also be emphasized that encouraging communities to properly time traffic signals to reduce the amount of stops and set appropriate speed limits to keep traffic flowing smoothly will increase fuel economy better than any individual effort. When traffic lights and speed limits are set properly, driving at the posted speed will result in better fuel economy and time savings. Removing unnecessary traffic lights and stop signs should also be looked at.

Bad information has lead to declining fuel economy over past several years, despite rising fuel prices, the purchase of better fuel economy vehicles, and flat and declining amounts of driving. Adaption of moderately poor fuel economy driving behaviors resulting from bad information and price pressures are further compounded by their effect on congestion.

fueleconomy.gov: fuelecnoomy@ornl.gov

Dept. of Energy: The.Secretary@hq.doe.gov

EPA, Energy Efficiency and Renewable Energy Information Center: Web Submission Form

Sunday, January 11, 2009

Top Fuel Efficient Speed

Back in 1998, the average was 55mph for the most fuel efficient speed. But modern cars have improved a lot. The average has likely increased for passenger vehicles and truck, and the range for all vehicles has certainly increased. I've read claims that some cars get their best fuel economy in the 75 to 80mph range.

Consumption Tax?

For starters, people confuse a gas tax with a Pigovian Tax. Pigovian taxes are largely accepted as economically stimulating in the long run. But a tax on a product or service that is associated with negative externalities is not necessarily Pigovian.

A Pigovian Tax is a tax that identifies negative externalities, prices their cost, and is spent directly on neutralizing the externalities (either by identifying the affected parties and compensating them, or spending on technology that prevents the externality). The national research council estimates the cost of externalities for gasoline consumption to be $0.26 per gallon for energy dependence and carbon emissions. That means that a Pigovian Tax would not be higher than $0.26 plus costs of infrastructure and pollution (Congestion cost cannot be included in a gas tax because congestion is a matter of when and where a vehicle drives. At most times and places, vehicles don't contribute to congestion.). The average tax on a gallon of gasoline is already $0.41 in the US.

Secondly, a gas tax is not a consumption tax. Gasoline is largely not an end use product, it is an input. Only for a small percentage of gasoline usage is gasoline an end use product (e.g., joy riding, snowmobiling, two-tracking, boating, recreational flying, luxury shopping and dining out, pyrophylic gratification). Usually it is an input for some other desired outcome.

Increasing input costs introduces risk to both individuals and businesses. When operating costs are higher, risk is higher and there is less certainty in the economy. It is harder to make good decisions.

Monday, December 29, 2008

Prediction for 2009

Fuel efficiency always declines in winter.

Thursday, November 20, 2008

Induced Demand is the Whole Point of Infrastructure Investment

Until people realize that Induced Demand is the whole point of infrastructure, not a symptom, it will just be pork.

Wednesday, November 05, 2008

Trends in Fuel Efficiency

Analysis is done with gasoline data only for simplification. Diesel fuel is widely used for purposes other than transportation.

Gasoline consumption data and price is from EIA. Monthly product supplied for Finished Motor Gasoline from the EIA. (I forgot what CPI I used to adjust Prices.)

Monthly Vehicle Miles Traveled is taken from Historical Traffic Volume Trends from the Department of Transportation Federal Highway Administration.

First graph shows actual DoT vehicle miles driven over EIA finished motor gasoline supplied change from previous month and regular gasonline price change from previous month.

Change in efficiency is calculated for each month/1-year-prior, using 12 month smoothed miles/gallons for each month.

Analysis:In the late 90s, the positive correlation of fuel efficiency and price pretty much breaks down. This is probably due to ocassionally bumping into the efficient capacity of roads and large scale use of electronic controlled fuel injection and and improvements in transmission (e.g. continuously variable transmission CVT). In addition to improving efficiency, the use of electronic controlled fuel injection and transmission improvements have decoupled the relationship of slow acceleration and fuel efficiency.

In the second half of this decade, the relationship of gasoline price and fuel efficiency becomes negative. This is likely due to oversimplified belief of “slow” being more fuel efficient. Slower speeds being more fuel efficient is limited to highway driving. Aerodynamic drag does not surpass the increased efficiency of higher operating speeds until about 55mph for typical vehicles (made before 1999). In addition, electronic controlled fuel injection and improved transmissions can mean that faster acceleration is often more efficient than slower acceleration. People often confuse the idea that slower highway speeds are more efficient with the idea that slower acceleration is, it often is not.

This is all despite less driving and large declines in truck sales.

Thursday, October 02, 2008

The Problem with Inflation Right Now

There seems to be two problems. The structure of cash flows don't match the expectations of banks when they bought these MBSec's, so many have a bad mix. Banks are afraid to lend to each other because they don't know who has a bad mix. The second problem is that aggregated, these MBSec’s have lost value for the same reason that banks ended up with a bad mix: Default Risk went up dramatically from expectations. Just like borrowers, banks are faced with lower asset values and lots of leverage (some banks should actually have higher asset value because they may own MBSec’s that are backed by cash flows that weren’t expected but are now coming in, like balloon interest rate payments).

Why did default risk go up? After 2005 oil prices went up ~100%, gas prices ~50%, other commodities went up… costs of consumables went up in price relative to everything else. Incomes for the majority were flat and negative. Expenses/Income increased significantly for the broader population. Viola, default risk jumps.

Here’s the problems with the solutions we’ve been given: Because costs have gone up so much relative to income, it can be expected that any inflation we will see will fall disproportionately on consumables. Combine that with the assumption that consumption and taxes are probably larger than income minus principal and interest payments for most people, it means default risk will rise with more inflation [until (Income – Tax – Interest – Principal Payment) is > Non-Interest Expenses].

UPDATE: Johnathan Gewirtz of chicagoboyz.net adds:

I don't know. It seems to me that the capital destruction caused by defaults and institutional failures (and expectations of more of same) is deflationary while recent Fed behavior has been inflationary. I don't think anyone knows how this is all going to shake out.

I'll add further: the velocity of money is down, so monetary expansion might not produce much inflation. The buying of T-bills to fund the policy would be contractionary too [but I have a feeling it will pull money from places we don't want to]. However, while the capital destruction should cause some deflation, the debts used to obtain the capital remain unchanged, so it drives up the real cost of principal and interest payments.

Little things that piled on: I think there was a bit of a gas price bubble as well. Poor reaction to high gas prices caused people to adopt inefficient driving habbits. This kept gas demand from going down much at all and reduced what we got out our gallon. Unfortunately, I don't think falling gas prices will make that go away. Fortunately, I don't think falling gas prices will reduce the push for more fuel efficient technology. The possibility of higher prices is enough to keep that going.

Another Update: Arnold Kling has an excellent summary up. I think this makes for an excellent set of lessons learned.

Mortgage Losses On Owner-Occupied Homes Lower Than Assumed from PhysOrg (via commeter at Lubos Motl's)

Wednesday, October 01, 2008

Handling the Housing Default Side of the Crisis

Here's a way to mitigate some of the problem.

Upon sale or foreclosure, the bank gives the borrower foreclosed properties on its books for the value, or partial-value, of the remaining debt.

Tuesday, September 30, 2008

Who Pays?

Everyone pays taxes and everyone is the taxpayer. When a blowup happens, it's the taxpayer who will pay. When there is economic destruction, the taxpayer pays. (And, conversely, when we pay taxes there is economic destruction… generally.)

Now that we've dealt that, who should they pay?

Should they pay borrowers, who didn't realize that living expenses might go up but their wages wouldn't, so they might want to default?

Or lenders who didn't expect the borrowers’ wages to stay low and prices to go up, leaving them less to make payments with?

Should we pay the flipper, who bought houses, hopefully with the intention of improving them and quickly selling? He didn’t know costs would go up and home values would go down, decreasing the return on his now costly improvements.

Or should we pay the lenders, who loaned to flippers at low rates, but put a ballooning interest rate on the loan so that the flipper would sell to someone else if he didn’t improve the property fast enough? He didn’t know that improvement costs would go up and tightening budgets would cause home prices to go down.

Or should we pay the banks, who bet that they would not see default risk go up, bet that they would receive sub-prime principal in lump sums, bet that they would not see sub-prime principal payments in installments after 2 years, bet that they would not see interest payments at ballooned rates, then borrowed on those bets and bet bigger?

Best and Worst Case Scenarios

Nothing is done. Banks, afraid to lend to eachother and faced with watching their assets depreciate, loan to good borrowers with higher down payments or collateral and lower interest rates. Portions of loans with 6% or higher interest rates are refinanced at a lower rate, probably around 4%, on the existing value of the house or other collateral, the owner must pay the portion of the principal not covered by the current value of the house at existing terms, but the current rate is locked in. Owners deemed too risky at the new low rates default. Some banks holding mortgage backed securities that are dependant on the cash flows on the portion of the loan refinanced and on defaulted loans go bust. The assets of failed banks are sold off and the debts are nationalized. Inflation is kept in check, so costs of living do not increase relative to income, so default risk goes down. Commodity production increases to take advantage of recent rises in prices, continuously rolled over long positions on commodities are seen as untenable long term investments. Money is moved away from commodities, and prices of consumables fall. Default risk further decreases and some risky assets become valuable again.

And now the Worst Case:

Bailout happens. Inflation increases, but home values continue to decline and wages remain flat. Home owners, with budgets already crunched beyond expectations, are burdened with even higher costs of living and default risk increases greatly. Defaults increase and home prices fall more. The bailout causes the interest rate the government borrows at to go up, moving money away from businesses and causes banks to expect higher interest rates from home buyers, putting further downward pressure on home prices. Scared money also goes from home and business loan to continuously rolled over long positions on commodities, which people expect production not to increase for but demand to remain. Prices go up relative to income, and default risk goes up....Credit markets freeze up within the next week and many businesses cannot meet their payrolls. Margin calls cannot be met and the NYSE shuts down for a week. Hardly anyone can get a mortgage so most home prices end up undefined rather than low. There is an emergency de facto nationalization of banks to keep the payments system moving... There is no one to buy up the busted hedge funds, so government and the taxpayer end up holding the bag. The quasi-nationalized banks are asked to serve political ends and it proves hard to recapitalize them in private hands. In the very worst case scenario, the Chinese bubble bursts too.

Here are Tyler Cowen's

And Commentary at Megan McArdle's

Update: via commenter Nelson at Megan's Industrial Companies Can Thank Banks for Lower Rates.

Money-market funds that gorged on the debt of financial companies are now pouring cash into Treasury bills and corporations which avoided the troubled mortgage bonds that contributed to the failures of New York-based Lehman Brothers Holdings Inc. and Washington Mutual Inc. of Seattle. Yields on 30-day non-financial commercial paper dropped to 1.86 percent on Sept. 24, the lowest since November 2004.

Lower short-term rates are proving irresistible to companies that haven't relied on borrowing, or leverage, to pump up profits.

General Electric Co., the world's biggest provider of aircraft leasing, jet engines, power-plant turbines, medical imaging machines and locomotives, is having no problems accessing the short-term debt market even though about half of its business comes from lending, Chief Financial Officer Keith Sherin said on a conference call with investors Sept. 25.But, then there's also this (via Instapundit):

Places off limits areas within fifty miles of the coast line, where 80 percent of the oil and gas deposits are. This bill, if it becomes law, will place these energy rich areas off limits permanently.

* Places off limits such energy rich areas as the Destin Dome off Florida and the super-rich areas off the coast of California on a permanent basis.

* In a gesture of what she probably thought was courage, Speaker Pelosi allows drilling on seven percent of the acreage offshore in the most difficult, deep water areas, one hundred or more miles offshore.

* If state legislatures sign on, drilling would be allowed in a further 12 percent of the untapped areas between 50 and 100 miles offshore -- again, difficult areas to explore and difficult areas in which to drill.

Monday, September 29, 2008

What Do You Say to a Banker That Wants to Lend to You at 6% Fixed?

Wednesday, September 24, 2008

Bubbles Are Purely A Monetary Phenomenon

Monday, August 04, 2008

Fuel Efficiency

UPDATE: This includes "Distillate Fuel Oil", which includes diesel, as well as gasoline. The data is very noisy because the Distillate Fuel Oil data includes Distillate Fuel Oil used for power generation, locomotives, and construction and industrial equipement. A large portion of the consumption does not correlate with miles driven, so it masks the trend.

The trend is much clearer when miles driven are compared with gasoline consumption only. This ignores that diesel use for commercial transportation could be up, diesel use could have improved in efficiency (congestion on interstate roads is down), and maybe only car travel is down. However, from a 2005 BTS study, commercial diesel vehicles only makes up ~7.5% of vehicle miles travel, diesel commercial vehicles only get 6-7MPG, and efficiency gains are not likely to be large.

Wednesday, July 30, 2008

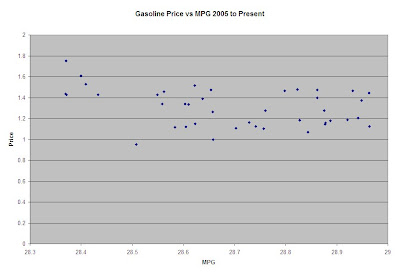

Miles Per Gallon Regular Unleaded Gasoline vs Price

Miles Per Gallon

13 Month Moving Average

Vehicle Miles Driven is from DOT.

Gasoline Consumption is from EIA.

My guess is that DOT over estimates VMT and/or EIA under estimates product supplied, leading to the high MPG calculated.

What's important here is the trend.

UPDATE:Finished Motor Gasoline doesn't include diesel. New numbers with diesel here.

Tuesday, July 29, 2008

Trends in Fuel Efficiency

Fuel Efficiency is higher now than back in 1998. Efficiency Declined from 1998 unitl the end of 1999 and then improved quickly. It remained relatively flat until 2004 and then began improving until the middle of 2006. Since 2006 fuel efficiency has been in steep decline.

(Data is from EIA and DOT. The graph is of % change from one year prior in vehicle miles driven minus gasoline consumption % change summed for each month since Jan 1998)

Friday, July 25, 2008

Rational and Irrational Reaction to High Energy Prices

I wonder, too, whether the recent decline in U.S. gasoline consumption doesn't represent to some degree an irrational panic reaction. To take a huge loss on the sale of your SUV in a market that is depressed because so many other people are doing the same thing at the same time is unlikely to be justified by the gains from the improved gas mileage of the car you buy with the modest proceeds of the sale. Likewise, driving a substantial distance to save a few cents a gallon on the gas you buy is unlikely to be worthwhile. A recent article suggests that people fixate on the price of gasoline because unlike most regularly purchased items, such as food, gasoline is purchased separately from other items so that its price is not buried in a bill for multiple items.

Pile on top of that, entirely rational reasons fuel efficiency may decline with higher gas prices.

And, it gets worse. From CNN, communities are cutting back on public transit, police, and road maitenance.

Food prices are greatly affected by oil. It accounts for most of the production cost.

Fuel consumption is declining much less than driving is.

Not to worry, people are discovering ways to reclaim their lost efficiency.

The last time there was a significant reduction in gasoline consumption was 17 years ago.

17 and a half years ago, there was an upward spike in oil prices in August 1990. It was followed by a recession from Sept 1990 to Sept 1991.

Tuesday, July 08, 2008

Gasoline Consumption and Vehicle Miles Driven

Monday, June 23, 2008

Two Lights

Getting rid of stop signs has also been proposed. I think this is a good idea. The vast majority of stop signs could replaces with yields, the rest eliminated, to the benefit of safety and traffic.

But the remaining traffic lights? I don't think we need them most of them. We don't need the red anyway. We should only have two traffic signals: Yield and Don't Yield.

With just green and yellow lights, we could help keep traffic moving and help it clear more easily when it does form.

Green means Don't Yield. Yellow means Yield. If you have a yellow, other traffic has the right of way. If there are cars in the interesection, you must yield to them. Changes to Yield would overlap other traffic. Like current yellow lights, if you are unable to stop, you may continue.

Friday, June 20, 2008

High Gas Prices Drive Down Fuel Efficiency

Last month it was reported that driving in the US was down 4.3% in March compared to last year. What everyone missed was that gasoline consumption wasn't. It was down less than 2%.

For the year, gasoline consumption is down little more than 1/2% [correction, DOE now shows close to 1% less fuel consumed for the year].

We aren't using less fuel, we're getting less done with the fuel we are using.

If the most efficient driving was being eliminated, it still couldn't explain the large difference in fuel efficiency. The driving being cut would need to be several times more efficient than normal to have such a negligible impact on fuel consumption. This is not plausible.

Among the reasons: Less efficient fuel mixtures may be being used; People are acting on bad advice. We've known for awhile now that accelerating faster is more fuel efficient (this is even before considering the beneficial effects on traffic), yet people believe the opposite; People may be driving more at high traffic times to generate needed income and be too tired and poor to drive at other times; And, during the economic slow down, communities may be neglecting good traffic management (e.g. not timing traffic lights properly).

We also need to consider whether higher prices will strengthen the movement toward more efficient technology or have little additional effect. (i.e. Has the move already happened and will further price pressure be of no value? After the crunch of the 70's, efficiency contitued to improve greatly despite falling prices.)

Additionally, we need to realize that in the mid-term, our current vehicle fleet and the infrastructure to produce more aren’t suddenly going to disappear. New tech won’t wash out these adverse effects.

[The gasoline consumption data can be found here: http://tonto.eia.doe.gov/dnav/pet/xls/pet_cons_wpsup_k_w.xls

It's in excel format. See U.S. Weekly Finished Motor Gasoline Product Supplied (Thousand Barrels per Day).

The Energy Information Administration defines Production Supplied as their calculation of consumption:

Products Supplied Approximately represents consumption of petroleum products because it measures the disappearance of these products from primary sources, i.e., refineries, natural gas processing plants, blending plants, pipelines, and bulk terminals. In general, product supplied of each product in any given period is computed as follows: field production, plus refinery production, plus imports, plus unaccounted for crude oil, (plus net receipts when calculated on a PAD District basis), minus stock change, minus crude oil losses, minus refinery inputs, minus exports.

More petrol data can be found here: http://www.eia.doe.gov/oil_gas/petroleum/info_glance/petroleum.html]

previous post

UPDATE: A mistake was made or the DOE revised their numbers. For the year, consumption is down close to 1%, not close to 1/2%.

UPDATE II: Large trucks do get less than 1/3 of the gas mileage of passanger cars (6.7MPG vs 22.9MPG 2005, DOT). However, they make up only 7.5% of total miles driven.(ANNUAL VEHICLE DISTANCE TRAVELED IN MILES AND RELATED DATA - 2005 BY HIGHWAY CATEGORY AND VEHICLE TYPE) If all driving cut was in passanger vehicles, it should still reduce fuel consumption by only slighly less.

Here are the weekly comparisons of 2008 over 2007, 4 week moving average 2008/2007, and the total consumption, year to end of week, 2008 over 2007:

Weekly | 4 Week Moving | Average Total

Week 1 1.12% 0.42% 1.12%

Week 2 0.62% 1.13% 0.87%

Week 3 -0.49% 0.42% 0.42%

Week 4 -1.65% -0.10% -0.10%

Week 5 -2.41% -0.99% -0.56%

Week 6 -0.45% -1.25% -0.54%

Week 7 -0.79% -1.33% -0.58%

Week 8 -0.83% -1.12% -0.61%

Week 9 -1.31% -0.85% -0.69%

Week 10 -0.29% -0.81% -0.65%

Week 11 -1.83% -1.07% -0.76%

Week 12 -1.45% -1.22% -0.82%

Week 13 -1.70% -1.32% -0.89%

Week 14 -1.96% -1.74% -0.97%

Week 15 0.98% -1.04% -0.83%

Week 16 0.57% -0.55% -0.75%

Week 17 -0.77% -0.31% -0.75%

Week 18 -0.35% 0.11% -0.73%

Week 19 -0.65% -0.30% -0.72%

Week 20 -0.78% -0.64% -0.73%

Week 21 -1.18% -0.74% -0.75%

Week 22 -3.85% -1.62% -0.89%

Week 23 -0.80% -1.66% -0.89%

Week 24 -3.54% -2.35% -1.00%

Tuesday, June 17, 2008

High Gas Prices Are Causing High Gas Prices

It seems I've been right. I've been looking more closely at the data at the Energy Information Administration. I've found the appropriate data set (see Product Supplied, Finished Motor Gasoline).

The EIA defines product supplied as the appropriate measure for consumptions:

Products Supplied--Approximately represents consumption of petroleum products because it measures the disappearance of these products from primary sources, i.e., refineries, natural gas processing plants, blending plants, pipelines, and bulk terminals. In general, product supplied of each product in any given period is computed as follows: field production, plus refinery production, plus imports, plus unaccounted for crude oil, (plus net receipts when calculated on a PAD District basis), minus stock change, minus crude oil losses, minus refinery inputs, minus exports.Gasoline consumption is down less than 1% (approximately 2/3 of one percent) compared to last year, while driving has been estimated to be down 4.3%.

This is a major decline in fuel efficiency. It cannot be explained by decreases in the most efficient types of driving alone. The driving cut would need to be several times more efficient than normal driving.

I’ve identified three reasons for the decline in efficiency I believe most likely(other than population growth combined with a lack of infrastructure growth):

3. Less efficient fuel mixtures (reformulated gasoline is making up a greater percentage of fuel).

2. Possible Giffen Behavior.

People are pressured to forgo luxury driving during off-peak hours, but must drive more during peak hours to produce a needed increase in income. And people are only willing to do so much driving in a day or week. People must drive more during congested times and are too tired to take the family out or take that country drive to visit grandma. Maybe mom and dad don't even want to be in a car any more.

1. Drivers acting on bad information (e.g. Accelerating slower rather than faster)

"It's not commonly understood by people who drive," Dr. Dougherty said. "They think that the way to get best fuel economy is to accelerate very gently, but that proves not to be the case. The best thing is to accelerate briskly and shift.

"Don't give it everything the car has, but push down when you're going to shift, using maybe two-thirds of the available power, and change through the gears relatively quickly."

Tuesday, June 10, 2008

How Many Carbon Accountants Does It Take To Smash A Lightbulb?

Megan McArdle answers the unanswerable question.

Somehow, she decides it's zero.

Never mind that if you can't count it, you can't control it, and you certainly can't raise its price.

It'd be like trying to tax or set the price of cocaine, keeping it illegal and still prosecuting.

Monday, May 19, 2008

All Else Equal... Global Warming Legislation Is Stupid

Ok, we have two alternate worlds with two identical villages, the exception being that Village A has only an income tax and produces greenhouse gasses. Village B has a combination of income tax and greenhouse gas emissions taxes. Village B's tax system implemented in a way that completely eliminates greenhouse gas emission, but has no effects on its ability to meet the material need of its population; i.e., the villages have the same GDP, population growth rates, etc.

Both populations start with 2000 people.

The population growth rate is 1.3% for both villages.

The GDP growth rate is 4% for both villages.

30% of both populations have IQs sufficient to perform higher level work requiring a college degree, and do so.

Lets say Village B has a .01 chance of a 100 year storm hitting which will kill .05 of the population and destroy .05 of the economy every year. Due to its greenhouse gas emission, Village A has a .011 change of being hit by a 100 year storm. Various engineering projects are available that will reduce deaths and destruction .005. These projects require 100 civil, environmental, or marine engineers to start.

Assuming a hundred year storm absolutely will not happen until at least 100 years from now, which village is at greatest risk from a hundred year storm? Please explain why and show any calculations.

Thursday, May 15, 2008

Giffen Behavior in Driving

Perhaps there is Giffen Behavior in driving. If the cost of driving goes up, we may get more demand for driving.

People are pressured to forgo luxery driving during off-peak hours, but must drive more during peak hours to produce a needed increase in income.

Added: And people are only willing to do so much driving in a day or week. People must drive more during congested times and are too tired to take the family out or take that country drive to visit grandma. Maybe mom and dad don't even want to be in a car any more.

Tuesday, May 13, 2008

Fuel Efficiency Continues to Decline

He fails to notice that along with the decline in fuel production is a decline in GDP growth.

He also fails to notice that miles driven have decreased much more than fuel production. That's right, fuel efficiency is declining with higher fuel prices.

According to Kevin, fuel production has declined by .7%. Average Daily Miles Driven have declined by 5%.

Some of this decrease in efficiency is due to increasing population and limited growth in infrastructure. Some may be due to people forgoing long trips to recreational destinations. But none of this comes close to explaining a 5% decline in driving. It's hard to believe that long recreational drives are a big part of American culture, let alone the greater than 5% of driving necessary to drive down efficiency.

I have my own theory. Markets only perform well when there is good flow of information. Because of people's misconceptions of what is efficient and how they affect traffic, they are modifying their behaviour in counter productive ways.

Popular belief is that people will notice their decreased fuel efficiency and correct their mistakes. However, among other complications, I believe gas prices are nowhere near high enough to get people to seriously consider the consequences of their actions.

[UPDATE: Giffen Behavior may contibute to decreasing efficiency]

Thursday, May 08, 2008

Should People Slow Down? Maybe, An Envelope Calculation

303824646 Population of US (2007 est, cia world factbook)

$13860000000000 Annual GDP of US (2007 est, cia world factbook)

(13860000000000 $/year) / (303824646 people*31556926 seconds/year) = .0014456 $/person-second [That's $4.97 an hour]

30 miles/gallon at 55mph (source, est from graphic)

23 miles/gallon at 75mph (source, est from graphic)

25 miles/gallon at 70mph (source, est from graphic)

28 miles/gallon at 65mph (source, est from graphic)

3.62 $/gallon May 4th US average (source)

1.63 person/vehicle (source)

3600 second/hour

(3.62 $/gallon * 55 mi/hour) / (30 miles/gallon * 3600 second/hour * 1.63 people) = .001131 $/person-second

(3.62 $/gallon * 75 mi/hour) / (23 miles/gallon * 3600 second/hour * 1.63 people) = .002012 $/person-second

(3.62 $/gallon * 70 mi/hour) / (25 miles/gallon * 3600 second/hour * 1.63 people) = .001727 $/person-second

(3.62 $/gallon * 65 mi/hour) / (28 miles/gallon * 3600 second/hour * 1.63 people) = .001432 $/person-second

Of course, this assumes that your daughter and grandmother are as likely to be the 1.63 occupants as you and your wife.

(Also, I don't like that consumption curve. That 55mph tripe is based on old vehicles, and may also include big trucks. I know my 2002 Mazda protégé is at 3400RPM at 75mph, still in the flat part of the torque curve.)

Sunday, March 02, 2008

Uncertainty, Considering What We Don't Know

But what if we're wrong? What would be more costly, if Alarmists are wrong, or if Skeptics are wrong? Which is more dangerous?

Cass Sunstein's book Worst Case Scenarios is a good start at contemplating what we don't know.

Recommendation

Dr. Sunstein considers many modes of thought and the book should get you thinking.

Throughout the book Dr. Sunstein uses two main narratives to examine how people react to uncertainty, Terrorism and Global Warming. He provides a very PC perspective, probably to better reach a broad audience and get them thinking about how we deal with what we don't know. The book is an exercise to get the lay person thinking about uncertainty rather than an objective analysis of how to deal uncertainties. It should get the reader to consider how we over and under react and how costly that is.

Sunstein makes the very good point that people have over-reacted to the historic risk level of terrorism (with much unnecessary cost in life and resources) and explores several reasons why. He also makes the point that probabilities alone are not enough to make decisions. Context is also important. That said, he possibly over emphasizes the fact that people over-react to more highly salient risks and he fails to thoroughly consider why people react strongly to risks involving justice and intent (especially that there is also a signaling component).

While most of us make the mistake of over-reacting to highly salient risks, Sunstein does the opposite. He makes the mistake of greatly exaggerating the risks of Global Warming. For the sake of argument, he makes up numbers. But the numbers are absurdly high, even when considering them as the likelihood that a risk will increase rather than the likelihood of an actual event happening or not.

When dealing with the uncertainty created by human actions, Sunstein also neglects uncertainty that already exists. The human component of global warming is small (and the greenhouse gas component of that is less than half). A large amount of uncertainty exists whether we reduce CO2 emissions or not. Building a particle accelerator creates a small, immeasurable risk of catastrophe. But Earth is surrounded by many particle accelerators which bombard the Earth and even produce collisions. Building one doesn't significantly affect the level of risk we face (and may provide us with knowledge that will help us avoid other risks).

The biggest qualm is that Sunstein advocates a policy of generational neutrality. He makes a good rhetorical argument, but logic is not on his side. He notes the consensus among economists that future lives should be discounted is unraveling. And unraveling is an apt term. The principle was long considered obvious to economists for the reason that it is obvious. When Sunstein asks whether the life of a 10 year old today is worth more than the life of a 10 year in 2040, he quickly answers, as many would like to, "No." But he fails to consider the obvious; that a 10 year old now will have 10 year olds of his own in 2040.

As to which is more dangerous, I think it's clear that regulation is far more dangerous than diversified growth. It's just that the imagery of catastrophic events associated with AGW (which is very unlikely to be mitigated by proposed regulation) is much more salient than the alternative of a much bigger, healthier, and wealthier future population.

Catastrophic events are discrete, but economic growth is compounding. So small changes in the growth rate make a big difference in well being over time. That's why a life now is worth more than a life in the future, because it affects the well being of the future. A catastrophic event that happens in the future will affect a smaller portion of wealthier society.

And it's unknown whether we are making catastrophes more or less likely.

This is just hillarious!

It's nice that people are starting to think more about what we don't know, but it'd be nicer if they'd think a little harder.

Cass Sunstien does a better job, and he's a lawyer.

Thursday, February 28, 2008

$4 Gas

Sure, it may happen. It's even plausible that it'll stay there.

But the implication that $4 gas will be the norm this summer is ridiculous. No suprize that Bush thought the idea was ridiculous. If he was keeping up on trivia like that, then I'd be really worried. That'd mean we really might see $4 gas in our futures.

Wednesday, February 20, 2008

Measuring Your Carbon Footprint Made Easy

CDD introduces the New Yorker article thusly:

“The carbon footprint of apples imported to New York from New Zealand can be less than for apples from fifty miles away. How can people make the right decisions? The answer is ...”The answer is way simpler than anything proposed in article.

To begin, of course things will be missed and there will be unrecognized distortions and mistakes made in any method used to calculate carbon emissions or Green House Gas equivalents. Counting airplane stickers and carbon units are likely to mislead you, but getting an accurate measure isn’t necessary to reduce your energy consumption (and therefore GHG emissions). There is a better and easier way that has been in practice for thousands of years.

Cost. Reduce your costs: Reduce your consumption: Reduce your emissions.

It won’t always be perfect (there are always distorting effects), but in general dollars represent energy, whether it be from calories or solar panels, that ultimately comes from the fossil fuels needed to develop and produce them (energy produced from solar panels will reduce costs once/if-ever the output exceeds the manufacturing and development requirements). Common to all goods and services, and included in the price, is the effort/energy to produce, transport, and develop products, perform services, and to sustain the producers, creative minds, politicians, and managers.

Cost should almost perfectly translate into energy consumption. Whether it’s the cost of transportation fuel, electricity for production, or producing the calories to feed employees and bureaucrats who regulate, in some way costs ultimately translate into energy resources. Somewhere in price is all the energy used directly in production and indirectly by financing the consumption of employees, owners, or funding of government welfare programs. Even for scarce, highly demanded materials (like diamonds) the price includes energy efforts to locate, extract, transport, and regulate. Beyond that, the high price funds the carbon intensive lifestyles of profiteers.

Things do get a little fuzzy. Just because someone profits highly doesn’t mean that they will consume more. The best way to be carbon efficient is to be prodigious in work and investment and frugal in spending. By investing, people can increase the production and decrease the costs (energy needed) of the goods and services that satiate the demands and desires of others. By minimizing cost and maximizing profits, we automatically meet more people’s demands, more fully, with fewer resources. The two things that people are most meticulous in measuring are their efforts and their finances. And, as shown here, when activities pose an externality on others, people are excellent at making them accountable.

Things do get even fuzzier. As mentioned in the New Yorker article, GHG like methane don’t correspond to price quite as well. However, growth in such emissions is much lower than CO2 (and emissions may possibly even be declining). And looking out more broadly, such gas levels are likely to be ultimately determined by interplay of the broader biosphere and atmosphere as CO2 concentrations increase. Regardless, if warming is your concern, you should be more focused on changes to lands and water. Changes to albedo and increases in humidity driven by changes in land use may cause more warming than the GHGs. And energy/carbon efficient practices aren’t necessarily less polluting. Shipping is more efficient than trucking and produces less GHGs, but produces far more pollution.

UPDATE: Wow! Solar panels may take more than I thought.

Thursday, November 01, 2007

National Horn Day

We need a National Horn Day!

One day a year. At every traffic light. When the light turns green. Everyone presses into their horn until they get to the speed limit.

People need to learn that efficiency means efficiency, both in time and fuel.

Save Gas: Avoid Brakes!

Accelerate Faster

Trends in Congestion

Why Peak Torque

High Gas Prices Are Destroying My Fuel Economy

The Big Deal About Gas Prices

Is Gasoline a Giffen Good

Giffen Behavior in Driving

Friday, August 03, 2007

Make Love And War

Population has always been a major component of war. The ideas of chivalry and sending men off to war and not women probably comes from the fact that the number of women in a society ultimately determines the upper bounds of potential population growth and ability to recover following a war.

Low population growth is viewed as a weakness by al Qaeda types and is a very big part of why they attack us.

Make the world safer by having more babies! In the interest of national security, we could create a tax holiday for households who have a baby in the 9-12 months following any significant terrorist attack.

This has three important impacts: 1) Increase in population growth, 2) A shift in timing of population growth that could send a powerful signal, and 3) Most strongly incentivizing childbirth for higher income (and, therefor, IQ and productivity) households.

It makes clear both the futility and absurdity of al Qaeda, and highlights the strength of the higher value given to women in the west and the higher proportion of women in our population.

Simply adopting a like policy could impact birthrates and fight terrorism by making it clear that even the mere thought of violence by a potential terrorist will cause ten more western women to get pregnant.

Safety in numbers you know.

One negative, which I hope is quite small, is that, primarily in the lower middle class, it would lead to bad long-term decisions to achieve a short-term gain.

It also presents as a type of social engineering policy, typically frowned on, in a more acceptable framework (tax cuts and national security).

Tyler Cowen on Traffic

I asked Tyler what he thought about my contention that gas taxes, like cap and trade, could lead to traffic problems and increased gas consumption. He graciously responded here.

Friday, July 20, 2007

Indulgances

Whooops!

Oh the irony.

[and they don't even address the problem that most trees don't pull much CO2 out of the air, they put most of it back, and ultimately they release all the carbon back into the atmosphere, much of it as methane and other more powerful GHGs. I wonder if they're deciduous trees, which basically convert a good chunk of CO2 into methane every year.

Oh, for those who don't want to do the reading, the paper says due to albedo and water transport/feedback effects, unless they covering very dark soil AND in the tropics, trees cause warming.]

Is Gasoline a Giffen Good?

I think I know the answer.

Update: What I describe isn't Giffen behavior, Giffen behavior is substituting a superior good with more of an inferior because the increase in price makes the superior good impractical to buy in sufficient quantity. It's a rational behavior, where what I describe is irrational. The Economist has a good clarification.

There no real superior good similar to gasoline, higher gas might cause people to use more to do more work to have gas for their leizure and personal business, but this is highly unlikely and wouldn't have much impact. It's not the same.

[related: What's the Big Deal About Gas Prices]

Wednesday, June 06, 2007

Why Peak Torque

A simplified description:

The load on the engine is about same regardless of which gear you are in, the RPMs being lower than peak torque doesn't mean much for fuel consumption. A lot more fuel is injected into the cylinders to provide the power needed to keep the car going at the lower engine speed, and power transmission (for acceleration) is less efficient at the lower engine speed.

Think of your car's mechanics as a set of springs that transfer all the forces acting on the car to the crankshaft. In order to provide the same power in less cycles per minute, more power must be provided by each piston in each cycle (more fuel, bigger explosion). But at slower engine speeds, not all of the blast energy is transferred to the crankshaft. The piston doesn't move as much during the blast (the blast occurs in a smaller space) so more of the energy becomes heat (some of the blast also becomes strain on the piston rod and cylinder). At about 3500 rpm, the pistons are moving at a speed that allows the explosive force to best transfer to the piston (the explosion is pushing as much as possible on the piston during the entire stroke). After 3500 RPM, the piston is moving so fast that not all of the explosive force acts on the piston.

It's also a lot like riding a bicycle. At high gears and low speed, you might not even be able to push hard enough to get going. You mostly just put a lot of strain on the chain. Instead, you use a lower gear and pedal less hard at a more comfortable, medium pace. Once you get going faster, you'll notice that you're spinning the pedals faster, but there is almost no resistance at all and you're wasting a lot of energy moving your feet so fast. So you upshift, resistance increases slightly, your pedaling slows slightly, and you're a lot more comfortable.

Tuesday, June 05, 2007

Try Telling That To Somone Who Graduated In 2000

Wednesday, May 30, 2007

High Gas Prices Are Destroying My Fuel Economy

I'm hitting more traffic lights and having to sit through multiple light cycles. I'm getting way less MPG.

More time on the road and more stops = more gas burned.

And engines are most efficient between 3000 and 4000 RPM. The extra fuel spent getting up to speed faster is negligible (you may even use less fuel).

(see also, Save Gas: Avoid Brakes!

and, Accelerate Faster

and, Why Peak Torque

and, The Big Deal About Gas Prices

and, Is Gasoline a Giffen Good

and, Horn Day)

UPDATE: An analogy to clarify:

It's also a lot like riding a bicycle. At high gears and low speed, you might not even be able to push hard enough to get going. You mostly just put a lot of strain on the chain. Instead, you use a lower gear and and pedal less hard at a more comfortable, medium pace. Once you get going faster, you'll notice that you're spinning the pedals faster but there is almost no resistance at all and you're wasting a lot of energy moving your feet so fast. So you upshift; resistance increases slightly, your pedalling slows slightly, and you're a lot more comfortable.

Tuesday, April 24, 2007

Is Crow an Idiot?

Sunday, April 01, 2007

I'm Fucking Pissed

I have chronic pain problems. Lot's of issues with repetitive stress.

I spent a lot of time ripping my music onto my hard-drive and suffered a lot of pain due to the process. Now, most of it is gone. iTunes won't play it. Don't know why. Can't locate it.

Someone needs to die.

Sunday, March 25, 2007

Why Do Handicapped Drivers Drive Like They're Fucking Handicapped

Friday, March 23, 2007

Too F'ing Funny

Wednesday, March 14, 2007

Naughty Elf

Sure it's a bit sloppy, but there's also a lot of very good information compiled in the thread.

And don't everyone forget to look at Nir Shaviv's sciencebits.com blog, in particular the CO2orSolar post and comments. Also the Cosmic Ray Flux Link and his primer on climate sensitivity. His paper on climate sensitivity. And where he politely takes climate fundamentalists to task on their own territory (and they state that even though he's probably right, he shouldn't get any attention because he jumped the gun in making claims previously).

Naughty, subversive elf.

.bmp)